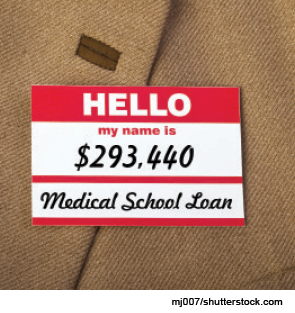

When it comes to debt management, physicians have specific needs. Their most common and pressing need is determining how to deal with student loans after completing medical school. On top of a mortgage-sized student loan debt, physicians may have accumulated credit card debt and other consumer debt after purchasing a home or car.

When it comes to debt management, physicians have specific needs. Their most common and pressing need is determining how to deal with student loans after completing medical school. On top of a mortgage-sized student loan debt, physicians may have accumulated credit card debt and other consumer debt after purchasing a home or car.

Explore This Issue

December 2014The amount of debt can be demoralizing. “Many of my physician clients have between $200,000 and $300,000 of student loan debt,” said Joshua Thompson, CFP, EA, president and founder of Consilium Management Group, LLC, in Tampa, Fla. “This can make life stressful when coupled with the fact that many residents only make $45,000 to $55,000 per year for the first three to five years.”

Having an action plan can help reduce the debt as well as the emotional burden. Options are available to help young physicians take control of their student loan debt. “The earlier a physician takes ownership of his or her debt, the more control they will have of their financial future,” Thompson said.

Here’s a look at some options you may want to consider.

Income-Based Repayment Plans

These plans are intended for physicians who have a lower annual discretionary income than their debt load. They are designed to make student loan debt more manageable by reducing the monthly payment amount. The plans come in three forms:

- Income-based repayment plan (IBR plan);

- Pay as you earn (PAYE) repayment plan; and

- Income-contingent repayment plan (ICR).

All of these plans extend the loan period, lowering the monthly payment.

Required monthly payment amounts are determined as a percentage of one’s discretionary income; percentages are between 10% and 20%, depending on the plan and when the loan was created. “Some recipients have no monthly payment if they have the right income and family size,” said Randy M. Long, JD, CFP, CExP, president of Long Investment Advisory, Inc., in Wilmington, N.C. To qualify for an IBR or PAYE, a physician must have federal student loan debt that is higher than his or her annual discretionary income or that represents a significant portion of annual income. To apply for a PAYE loan, you must be a new borrower as of October 1, 2007, and must have received a disbursement of a federal direct loan on or after October 1, 2011.

Income-driven plans benefit physicians who are unable or unwilling to make the monthly payment of the government’s 10-year Standard Repayment Plan. “The plan is attractive because the loan is usually forgiven after the end of the term (often 25 years),” Long said. “The downside is that these types of loans take an incredibly long time to pay off and only serve the physician who has debt loads representing a significant portion of his annual income.” In reality, income-driven plans are only worthwhile if the physician can qualify for a lower monthly payment than those available from the 10-year Standard Repayment Plan.

The earlier a physician takes ownership of his or her debt, the more control they will have of their financial future.—Joshua Thompson, CFP, EA

The earlier a physician takes ownership of his or her debt, the more control they will have of their financial future.—Joshua Thompson, CFP, EAPublic Service Loan Forgiveness

The Public Service Loan Forgiveness (PSLF) Program encourages physicians to choose a career in the public service sector of medicine, promising to pay off a physician’s remaining federal student loan balance if he or she works full time for a qualified employer and makes 120 qualifying student loan payments. A significant advantage is that this forgiveness is not taxable, unlike other forgiveness options.